Coins, Banknotes & Tokens

Features include: numismatic news; a "what's on" section that lets collectors know about fairs, societies, auctions etc.; an "ancients" section; "Auction Highlights" - where you can find out what has been happening in the salerooms; information on tokens; numismatic book reviews; a banknote section and a directory that allows readers to see what lists the main dealers are offering that month.

Latest Issue

Inspecting the King's Coinage

Volume 61, Number 4 / April 2024

What it’s all about THIS year, 2024, marks an incredible 25 years since Token Publishing Ltd started using Buxton Press, high in the Peak District of Derbyshire, to print our magazines (our books are either printed locally or in Wales, we prefer using UK printers for everything). We don’t get up to Buxton as often as we should, and they don’t get down to us that often either, as the journey isn’t an easy one, but that hasn’t stopped us building up an excellent relationship with them over the years (they sent us a very gooey silver anniversary cake, it was incredibly sickly, just as a cake...

Find out more Free trial issueMedals & Military History

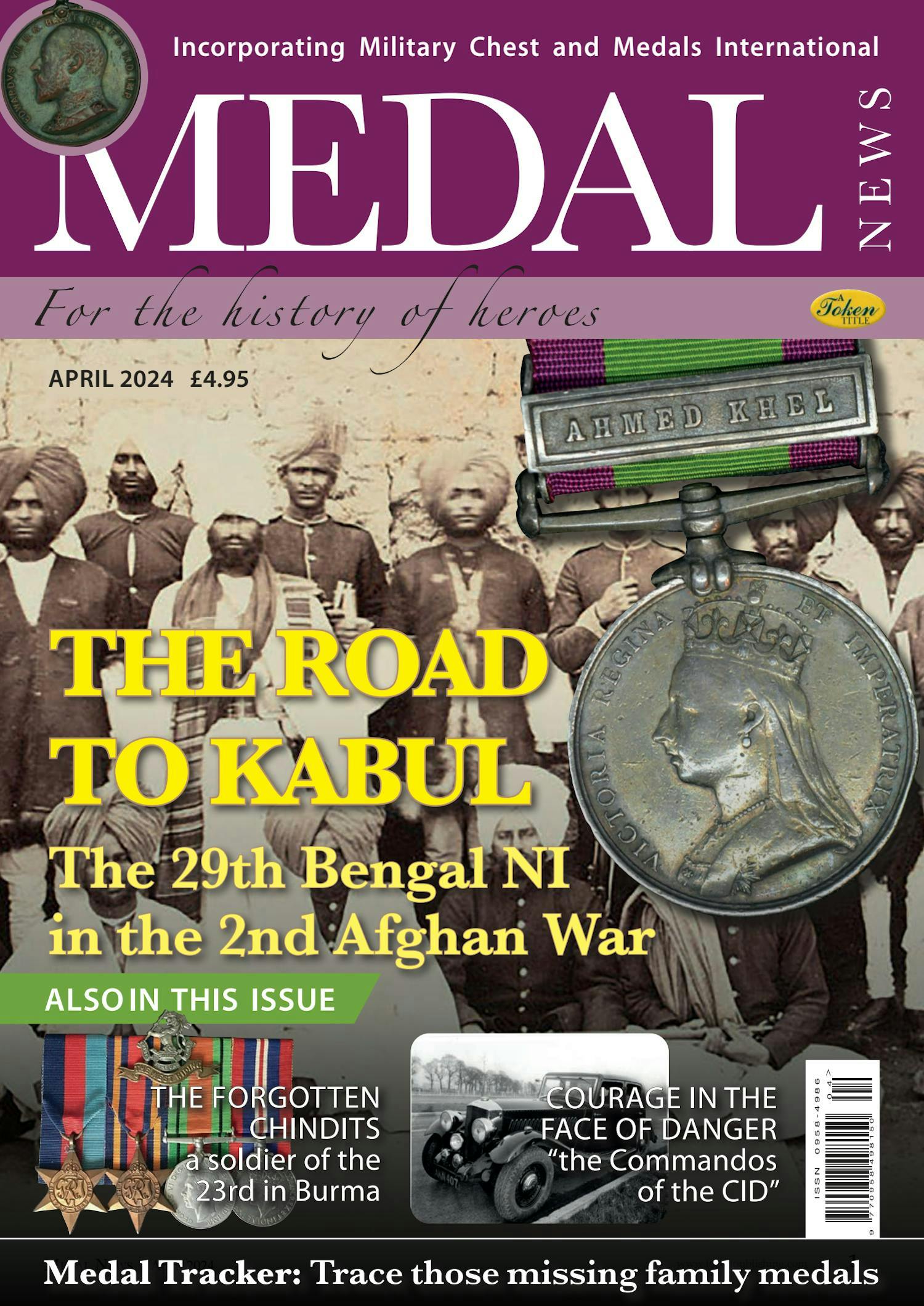

The worlds' only independent magazine devoted to medals and battles. Published 10 times per year, the magazine features articles, news, auction reports and the world renowned Medal Tracker service, invaluable when searching for lost medals and trying to re-unite broken groups. This service, like the classified advertising, is free to subscribers. Also included is the "what's on" section that lets collectors know about fairs, societies, auctions etc.

Latest Issue

The Road to Kabul

Volume 62, Number 4 / April 2024

Collectors at heart IF I were to ask you to name your “fantasy” medal(s), the ones you’d buy if money were no object, I am fairly sure they’d come from a small list. If we assume you purchase all the family medals you’re able then I guess next would be a Victoria Cross; a Charger of some kind (Light Brigade, Heavy Brigade, 21st Lancers); something from the big “Zulu” battles; a battle of Britain pilot’s DFC; a Defence of Legations China War (see News & Views this month if you want one) or Defence of Mafeking QSA; a large Gold Trafalgar NGS; an Army Gold Cross, or Naval or Army Gold Medal,...

Find out more Free trial issueLatest News

Stop thief

Stolen from Bearnes, Hampton & Littlewood's Exeter Salerooms on or around March 19-20: 1914-15 Star trio to 1026 Pte P. Taylor R.IR. Regt. Any information via 101 to Devon & Cornwall Police please, crime reference SP-25439-24-5050-01

Read moreThe Road to Kabul

Collectors at heart IF I were to ask you to name your “fantasy” medal(s), the ones you’d buy if money were no object, I am fairly sure they’d come from a small list. If we assume you purchase all the family medals you’re able then I guess next would be a Victoria Cross; a Charger of some kind...

Read moreSubscribe from £10.00 per year

Save money when you take out a subscription to either Coin News or Medal News for yourself or a friend.

Inspecting the King's Coinage

What it’s all about THIS year, 2024, marks an incredible 25 years since Token Publishing Ltd started using Buxton Press, high in the Peak District of Derbyshire, to print our magazines (our books are either printed locally or in Wales, we prefer using UK printers for everything). We don’t get...

Read more